Quite a few people have reached out to us who are moving abroad to the US – or they are thinking or dreaming about it. They found this post on getting settled in the US helpful.

As I have moved overseas many times before, I understand how scary and confusing it can be. There is a lot to consider and organize when you move abroad.

We’ve moved abroad over 5 times, yet it’s still an extremely stressful, overwhelming, and exhausting experience, especially now that we have kids to think about.

Although our specifics in this moving abroad post are related to relocating to Raleigh, North Carolina, a place we fell in love with whilst teaching in nearby Johnston County, you can apply the principles to wherever you are moving – USA or not.

If you’re moving to Raleigh, you’ll also want to check out our other site dedicated to Raleigh, which also has a fun community attached to it. Go to ThisIsRaleigh.com

Here are some things to have when you first move abroad to help you get set up:

Address

If you can use a friend’s address before you move to your new country, this will help you immensely.

So much of what you want to do, you can’t do without a local address. If you have employment lined up already, perhaps your company has a solution in place for this.

Phone Number

If you can’t get set up with phone accounts from the beginning – we could because we had a friend’s address and social security numbers and a decent credit score – buy a SkypeIn number. We used this for the first couple of weeks before we got our new Verizon cell phone accounts.

It was hugely helpful as everyone wants your phone number! When you are apartment hunting or searching for a car to buy, people will want to call you.

Social Security Numbers

This is just for USA relocation, but whatever country you are moving to consider this from the perspective of their tax numbers.

Social Security number is basically your tax ID. It’s tied to everything in the US and so difficult to do anything without one.

We were fortunate to have Social security numbers already from when we moved over in 2004. My employer was able to provide all the documentation to get one easily. (This time, however, we’ve had to get an EIN number for our now LLC.)

Note: if you don’t have a social security number or a good credit score, you may have to pay a lot of deposits for security. Have money in your savings to cover you getting set up.

For example, without our good credit score, we would have had to pay a bond of $1,500 on our apartment instead of $300. And last time we moved to the US with bad credit history we had to put down an $800 bond to get a cell phone plan.

Are you looking to buy or sell a home and are in needed of a real estate agent in the Raleigh area? As a Licensed Realtor and referral agent, I can save you the time and stress searching and vetting, and connect you to my team of trusted Realtor partners.

Click here to get started nowFinding an apartment when you move abroad to the US

What you’ll need for apartment hunting:

- Photo identification – even when you are touring apartments or rental homes with an agent. It’s a safety precaution and they won’t show you otherwise.

- Proof of income – Being self-employed we couldn’t do this. So we provided bank statements to show the money being deposited into our account. They will want to see three times the rental amount in income each month.

- Renter’s Insurance – we could not move into our apartment until we had renter’s insurance. You can easily get it with one phone call. We got ours with All State.

- Electricity on – make sure you connect the electricity before you move in.

- Security deposit/bond – depends on the policy of where you rent. We paid a small deposit + the first month’s rent in advance. They only accepted money orders, which was a pain for us to get such a large amount of money in cash from our Australian bank accounts. We wrote a post sharing that story on how to transfer money overseas.

- Application fee – This will depend on where you apply, but it was $50 per adult. This covers your police and security background check

- Administration fee – to cover the costs of getting you an apartment.

How We Found Our Apartment in Raleigh

Apartment hunting is a headache. There are so many factors to consider and so many options.

Trying to find the right place in the right area using online sites like Realtor.com was time-consuming. When you find an apartment you’re interested in, you have to set up appointments to see the places, which takes a lot of juggling around. It was wasted time we didn’t like.

We decided to go back to how we found an apartment the previous two times we moved to the USA – get in the car and drive around to the areas we want to live in and talk to the people in the leasing office.

You can easily view apartments when you visit as most complexes have show apartments so you can get a good idea of the layout.

We originally didn’t want to live in an apartment but decided it was the easiest short-term option. There’s more availability, better amenities, and less for us to manage.

We spent two days visiting apartment complexes before finding one perfect for what we wanted. We love it and it’s in our favorite location close to everything we love.

The girls love cooling off each day in our apartment complex swimming pool. It’s going to be a great home base.

Beware the Daily Rental Rates

The amount per month for apartment rentals changes every day, almost like airline prices, it’s bizarre. I don’t know how they work this out, but it can mean a huge difference in the price you pay.

Due to a mess up with our application, our rental price went up an extra $30 a month the next day. We were also apartment hunting at a busy time for rentals, so the daily rental rate now is higher than what it would be in April.

We signed a 10-month lease. Rental rates are cheaper the longer the lease you sign.

If you don’t want to renew for a longer period of time, and want to rent on a month to month basis, you have to pay whatever the daily rental rate will be at that time for the month-by-month rate.

For us, that will mean an extra $300+ rent a month for us. But as our lease expires in April, if we renew for a year long lease, it could be $200 cheaper a month!! Go figure!

Getting credit history

Everything in the US relies on credit history. It basically runs your life!

So having a good credit history and FICO score can bring huge benefits. But, it’s hard to get a credit history if you can’t get credit in the first place!!

As mentioned, you may have to pay deposits for things like phone plans. This will help you start getting the credit history, so pay them.

Then make sure you pay all your bills on time. Set up automatic payments so you don’t miss them. All this gets reported to one of or all three credit reporting agencies; Experian, Equifax, and Transunion.

If you have an American Express credit card from your home country, they make it pretty easy to transfer that over to the US. If you can do that, you are on your way.

The other option is to get a secured credit card. This is when you put your own money on the card and use it as if it is a credit card.

Again, ensure you make your payments each month and your credit score will build. We had our original secured card years ago from Chase Bank. That helped me get the Chase Sapphire Preferred credit card this time around.

Be patient, it takes time, but it’s worth it.

Getting furniture and homewares

Deciding to rent an apartment meant we’d have the added expense of furnishing it.

We’ve done this multiple times when we’ve lived abroad and we’ve always used Craigslist or even the Salvation Army because every move has had the intention of temporary behind it.

This time, I’m here to stay in the USA.

I know that I’m here to stay as I’m so guided by my inner voice and it is settled in and comfortable. It is the first time in my life I have bought nice furniture and house furnishings without thinking its a complete waste of money.

We’ve not gone crazy. We still follow a minimalist lifestyle without upsetting comfort style of living, but I can’t tell you how much I love my furniture and how happy it makes me feel to see it in my home. I feel like a grown up finally!

I ran figures before deciding to rent an apartment to know we could make this work.

One day over a Mexican lunch in Gatlinburg the idea pinged in my head to get a Chase Preferred Sapphire Credit Card. I knew that was one of the best cards to get for travel rewards and my credit score was good.

So I applied from my mobile phone and was accepted immediately.

If I spent $4,000 in three months, I’d collect 50,000-mile points. Too easy.

Even if I could not pay off the full amount at the end of the month, which I highly recommend you do when you travel hack using credit cards, I knew I could within a couple of months and the interest I’d pay would be minimal.

Put it this way, it would be way cheaper than the currency exchange loss and international transaction fees I’d cop using Australian money or credit cards.

It was a smart move.

We also discovered a 60-month interest-free loan with Rooms to Go.

I love interest free repayment deals like these. I use them all the time. You some times have to pay a little more for the products as the quality is higher, but it saves me having to use credit or money I don’t have.

This is a great strategy to use if you are starting out and you’re buying something you really need. I’ve used them before when my computers have died and I can’t work and don’t have spare cash. It helps me get back in business.

So this was perfect for us. It meant we could get the big furniture essentials up front and pay it off with low monthly installments for the next 60 months – no interest and no Australian dollars used.

IMPORTANT – if you follow this strategy, make your repayments each month and pay it off before the end of the term, otherwise, you’ll be stung real bad with hefty interest fees.

Do not overextend yourself and get caught with this!

If you are making your repayments each month, it is also a great way to build up your credit history.

You can always pay off the balance earlier. I’ll be paying it off early because spending most of your credit limit can actually be detrimental to your credit score. It’s best to only spend 30% of your available credit line.

With Rooms To Go, you do have to pay sales tax and delivery up front. The super annoying thing about the US is that sales tax is added at the end. It’s something I always forget to calculate so end up with receipt shock at the cash register.

After we bought the big items, we purchased most other stuff on Amazon or at Wal-Mart and Target.

We have become huge fans of Amazon Prime. I can’t believe how I can order stuff that gets delivered to my door the next day for free and at great prices.

We got some really great deals online at Walmart too. You can get things that aren’t in the stores. We got the girl’s desks and bed side tables for really cheap and our outdoor setting was $200 off and delivered in two days.

The TV stand we got from Amazon was a bargain and gorgeous and way cheaper and better than anything else we saw in a store in Raleigh.

I really am in love with our apartment and how it is set up. Simple, comfortable, light, soft and bright.

Banking and Finances

What a headache!

I swear, trying to transfer my money overseas has been extremely stressful and has required a lot of problem-solving.

You’d think with today’s modern online world sending money abroad would be easy. Not so. I’ve had that many road blocks to navigate around and everything has taken so much time.

We’ve changed business structures as well and set up our business under a US LLC which has made the transferring of funds difficult as we’ve had to consider tax implications.

And online payment systems like Payoneer and PayPal have different rules to navigate as to where and how you can transfer certain money.

It took ages for us to set up a bank account originally as we were waiting for our new LLC to be finalized with an EIN number so we could set up a business account in the US.

After a lot of research, we found out Wells Fargo Bank was the best option for a business bank account.

Chase also came out as one of the best. I do have a personal Chase credit card and I intend to get a Chase business card as they have the best reward program for travel.

We decided to bank with Wells Fargo as they are nationwide (helpful for us as we travel across the US) and we want to establish and build business banking relationships which can work in your favor in the future when it comes to borrowing etc. We were really happy with the service we received and our choice.

We were really happy with the service we received and our choice.

I had heard in an Aussie expat Facebook group I am in that Wells Fargo seemed to be the easiest bank for newcomers to the US to get started opening an account with. So that’s one to consider if that is you.

It has taken me weeks, if not months, to sort out our finances, transfer our money, switch automatic payments, set up automatic payments.

Oh, my. I’ve just got it finalized right at the end of the Australian tax year so hopefully, it will be smooth from now on.

I can’t tell you how relieved I am to now have everything operating from two bank accounts in the US. Most of our business expenses were USD anyway so it feels great to know I’m operating in one currency.

It’s a no brainer.

I’ve done the research, created my own case studies to test it and it’s the bomb. Ofx.com for the win.

Finding Nearby Services

I use sites like Groupon to help me find the right services such as hair salons.

You can get cheap deals and use that as an opportunity to decide if you like the salon or not. Better than paying a high price to start off with and hating it!

We are in the perfect location – short driving distance to all our favorite grocery stores: Costco, Whole Foods, Trader Joes, and Harris Teeter.

These help us to save money on our grocery bills and get the right food products for our gluten free diet.

Because of the savings we can get at these stores, we have almost a 100% organic diet now. (My health values are so happy)

I also order a few products, like organic raw cacao (can you believe I can’t find it in a store anywhere) from Amazon, and I’ve recently discovered Thrive Market an online store selling organic produce on the cheap. I saved $80 on my first shop. Brandless is another one my friend just told me about.

Time to Travel Again

Now that we have all this completed and we’ve settled in, we’re ready to get back to traveling again.

It has been a horrendous month.

Not only were we dealing with apartment hunting and getting settled in, we’ve also had to switch over our business to become US tax residents, finalize our Australian taxes, and we were hit with a legal trademark issue so I had to redesign my entire Money Mindfulness Course (as it’s now called) and we had an email spamming attack with hundreds of irate people contacting us.

I really felt like this was the month that was going to do me in and lead me down the quit path.

But, I’m still here.

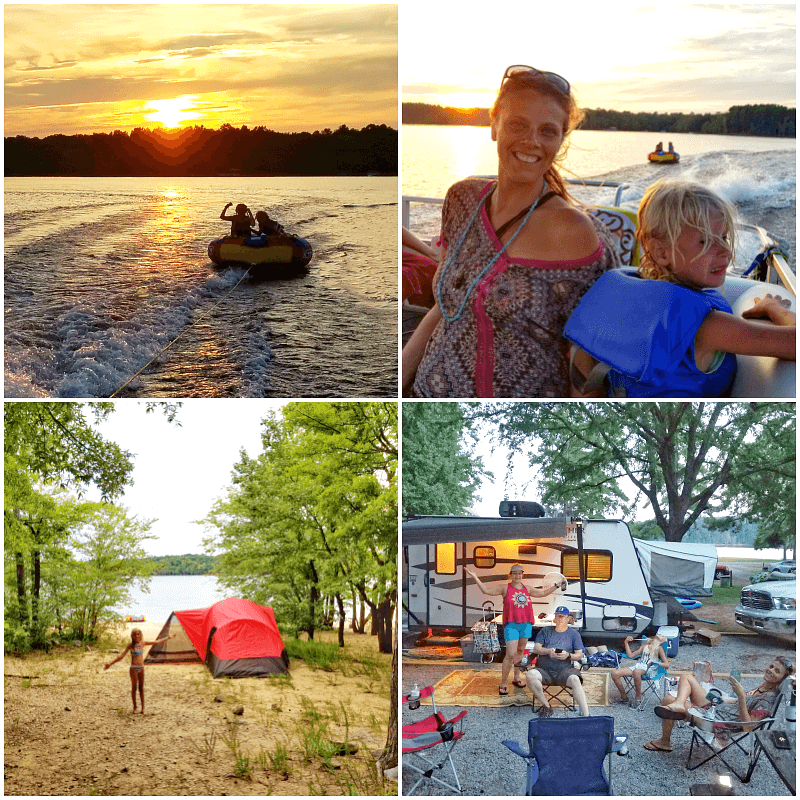

We’re going camping this weekend with friends at Kerr Lake in North Carolina to hug some trees, relax and de-stress – check out our Instagram stories.

Currently at Kerr Lake and having a ball camping and tubing and chilling!

Here’s What Else Is Coming Up for Travel:

- August:

- 30Year Dirty Dancing Festival at Lake Lure, North Carolina (This region is so pretty. Follow our Insta stories for the inside scoop)

- Charlotte for a conference

- September:

- 6 night Caribbean cruise on Carnival Vista. The girls cannot wait.

- I’ll be speaking at the Social Travel Summit in Austria. I’m excited. It will be my first time in Austria and I’ll get to spend a few days playing in the mountains.

Plus we are planning lots of East Coast US travel for the fall.

You can read more in this post about how we’ve settled into life in the USA. We share how we set up phones and financed a car.

We’re currently figuring out health insurance (scariest thing ever) and will let you know what we work out!

Pin this to share to Pinterest:

What’s helped you when moving abroad? Any tips for apartment hunting or getting set up?