This post may contain affiliate links. We may receive a small commission, at no cost to you, if you make a purchase. Read Disclosure.

If there is one thing I hate, it’s paying banks fees and helping the banks to make billion dollar profits with little in return. I’m always looking for ways to reduce fees especially when it comes to transferring money overseas.

How to transfer money overseas with the best exchange rate

The banks totally rip you off by NOT giving you the best exchange rate and then lump on huge international money transfer fees on top.

The last few weeks have been quite stressful as we set up our life here in the US. We’ve had a lot of relocation expenses as well as transferring our Australian business to a USA LLC and transferring our money overseas to the US.

It’s hard to stomach the lower dollar amount you get with the currency exchange as well as all the fees you pay with international transaction fees, withdrawing money from a foreign ATM, and then sending your money aboard from bank to bank.

The banks are taking your money every chance they get AND the currency exchange rate the banks give you is horrid and nowhere near the amount the AUD to USD rate is trading on the market.

I can’t tell you how much we’ve lost in foreign transaction fees and exchange rates over the past few years with our business expenses and now relocating over to the US.

Now that we were transferring large amounts of Australian dollars overseas, I’ve been keeping a close eye on the exchange rate for the Aussie dollar to the US Dollar so we can get the best exchange rate possible.

Last week, the AUD closed higher at 0.76, the best it had been for awhile. It was time to transfer some of our Australian money to our US bank account.

I went to make the international exchange via our Commonwealth Bank account and saw the exchange rate at 0.71.

What? How could the exchange rate be that big of a difference?

When you use your credit card to pay for international transactions, you rarely know the foreign exchange rate you’re being charged as the purchase is immediate and you don’t have the rates in front of you.

But when you transfer money online internationally, the bank (hopefully) tells you before you hit the send money overseas button!

That was just a scandalous difference, especially considering they were going to whack on another hefty $22 wire transfer fee.

PLUS, I’d get hit with another $15 incoming wire transfer fee on the Wells Fargo, US bank account side.

It might not matter so much if you are transferring small amounts of money, which I doubt if you are relocating your life to another country.

On a transfer of $10,000, you could end up paying $500 to the banks for their currency exchange margin they take (usually a 4-7% margin!), plus the fee for the service (plus any fees charged by the recipient bank to accept the funds – often another $15-$30.)

I decided to check the ING exchange rates and whether it would be better to transfer money overseas via there.

The only reason I still have an account with Commonwealth is because ING doesn’t offer business accounts. Shame because their personal banking is brilliant. (Although they do have business saver accounts, which we had and was great!)

I highly recommend to any Aussies that you switch your bank account over to ING. You can withdraw money from any ATM account (Australia) and not pay ATM fees. They also have low fees for ATM withdrawal overseas $2.50 with no withdrawal limit.

They saved us recently as we had to withdraw money from the ATM to pay for our apartment deposit as the complex would only accept a money order!!

Westpac limits you to $500 a day so we were looking at sleeping on the streets for a new night till we could get the cash.

Thankfully, I could get the rest out of my ING account in one withdrawal.

Boo hoo to Westpac Bank – the worst offender for international money transactions

While I’m ranting about the banks, let me tell you how bad Westpac is!

They are the only bank account I have (out of Commonwealth, ING, Westpac) that charge you an international transaction fee of 3% on the money you withdraw from the ATM machine.

How bad is that?

Most just charge an ATM bank fee. So not only are Westpac stitching you up with a low currency exchange rate, they are charging you an extra 3% and if you don’t use a Bank of America ATM they’ll add an extra $5 on top.

Kill me now.

Westpac takes the crown for the worst. They make me want to sleep with all my money under my bed.

We’re working hard to earn money, we give it to the banks to keep safe for us, (investing it behind our banks to earn profits) and then they charge ludicrous fees to do so.

And I also will rant about Bank of America.

I received the rudest service from the ladies when I was asking for help to get money out of my account to pay my apartment deposit. I couldn’t believe it.

I was just asking if they could help and they were acting like I was plotting the greatest bank heist ever. I kept coming in and out of the bank to use the ATM figuring out how to get my money and each time I did they were still there at the counter talking about me to each other.

All I asked was whether I could make an over the counter withdrawal instead of the ATM.

I was so annoyed I scratched Bank of America off my list of potential business bank accounts in America and went to Wells Fargo who have been excellent.

Wells Fargo’s customer service was outstanding – very warm, welcoming and helpful. I’ll never use Bank of America. Definitely not a bank I’d trust after the treatment I received.

Back to ING and how to transfer money overseas with the best exchange rates

I discovered that ING do their international bank transfers via ofx.com. Another reason I LOVE ING.

They’re not taking advantage of opportunities to take more money from you, they are sending you to a company that put $200 back in my pocket on my first international money transfer. Ha. Screw you Commonwealth and Westpac!

I signed up to OFX.com straight away.

It turns out you can transfer money from any bank account overseas via this platform. And guess what the rate was…

0.74 with NO fees.

Yep. HUGE difference

Huge Cheers for OFX.com – the best exchange rates for transferring money overseas

If you’re in my email community, you may already be saving yourself some money by transferring your money overseas using OFX.com. I share my insider tips with them first so I told them about it a few weeks ago. I received lots of “thank you so much emails”

You can join the VIP travel tribe and get the insider tips first too!

[newsletter]

A few days later, I received an email from someone at OFX saying they had received a lot of new clients with me listed as the referrer and if I’d like to partner with them.

I said yes. We partner as affiliates for certain products or services we love and recommend. We use them, like them, trust them, fall in love with their value and share it with you.

We value our readers and we value authenticity and honesty.

So within this post are links to OFX with our partner ID. We receive a referral fee if you do. We’re not bothered if you don’t. We just want to share this amazing resource with you for saving money when transferring money overseas and sticking it to the big banks.

Here’s another reason why I love these guys. They’re on the good team.

They did not have to reach out to me like this. They could have just taken the people signing up from my recommendation without giving anything back to me. I love them. I’m going to tell everyone about them regardless.

But they tracked us down and sent me an email to say thank you and offer to partner up. Not only that they said they would credit every person who mentioned me as a referrer already AND they would give you all fee-free transactions and look after you!

I’m telling you this because I think that is pure CLASS and a sign that this is a good company.

I tell ya I’m a raving fan.

Who are OFX.com

Yet another reason I love them.

Launched in a garage in Sydney’s western beaches in 1998 with a simple goal to give people a fair go.

In 17 years they’ve grown from two employees to over 200 and have managed over 1 million transfers totaling over $100 billion AUD. They offer 55 currencies, have offices around the world and offer 24/7 support.

They’re regulated by ASIC (Australian Securities and Investments Commission) and their parent company is listed on the Australian Securities Exchange (ASX) so your money is safe.

OFX.com have received a CanStar award for outstanding value in money transfers.

How cool is that?

I love their story, I love their service, I love how they save me money, and actually, care about doing that. Not like the banks who’ll take more than they need.

And they’re Aussies. So brilliant.

But don’t worry if you’re not Australian. They’re online. You can use them from wherever to transfer money overseas to wherever (well out of their 55 currencies).

I’m using them now from the US to pay my Australian designer with my USD to exchange over to AUD. Ha ha. Life sure can be confusing sometimes.

How to find the best exchange rate when you transfer money overseas?

Now I’ve been checking since my first international money transfer with them to ensure I get the best rate. Yes. Every time.

So far, PayPal has been the only one that has come closest to OFX.com for giving me the best deal.

This is what I do to find the best exchange rate to transfer money overseas:

- Check the price in OFX

- Check the currency exchange via your normal banks

- Check the exchange rate with PayPal

- What are the fees to transfer money overseas?

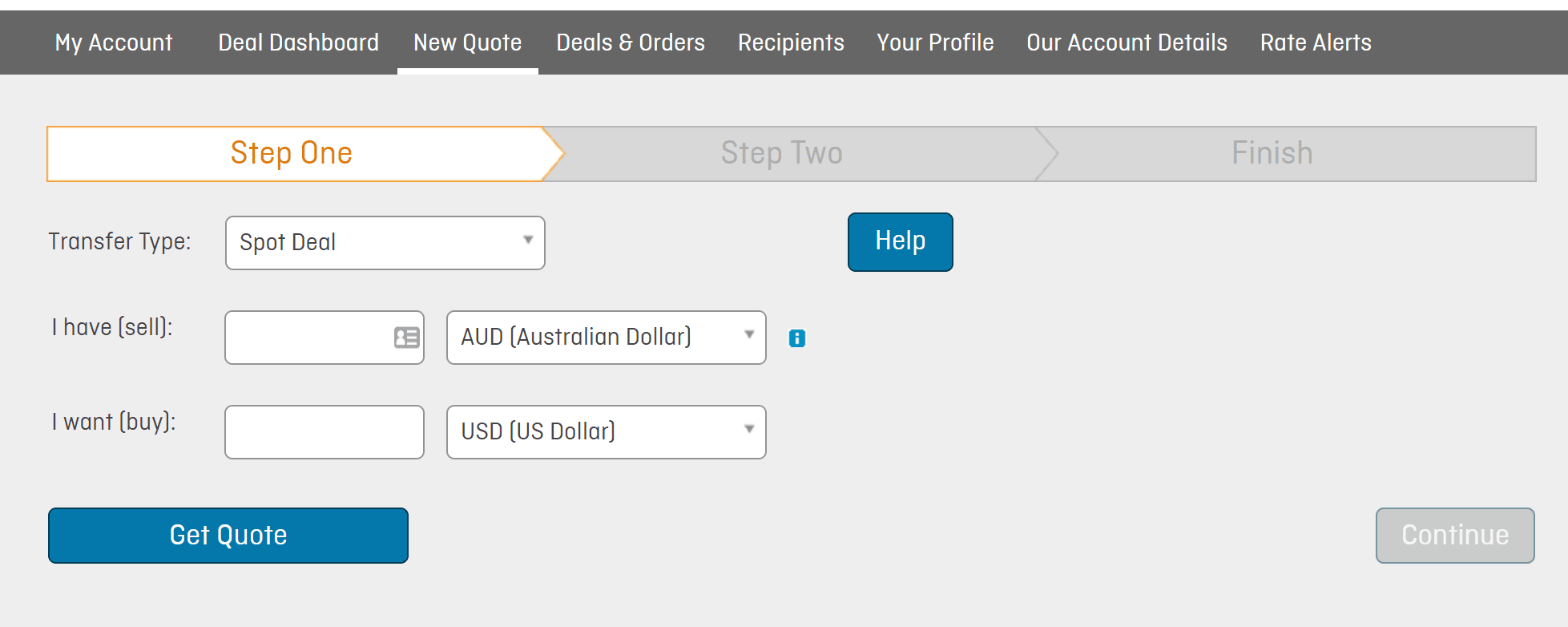

Check exchange rates in OFX.com right now:

How to transfer money overseas using OFX.com

It’s really simple:

- Login to your OFX account & get a live exchange rate quote

- Enter the recipient bank account details to book your money transfer

- Send OFX the funds. They’ll tell you which bank to transfer the funds to. They match you up with an account in the destination you are transferring the funds from. So when I transferred Australian money to My US bank account, I sent the Australian money to an Ofx.com Australian bank account.

- OFX.com deliver the funds to your nominated bank account as quickly as possible. I received my money transfer in two days but I had put in the wrong account number which delayed it. Oops. Doing international banking while flustered.

How can you use OFX to pay for travel expenses + other benefits?

- If direct debit payments are an option to pay for your travel expenses, you can transfer money via OFX.com to pay for them and lock in a much better exchange rate with no foreign transaction fees!

- It’s perfect for anyone relocating overseas. Transfer your money from one country to the next and save on fees and currency exchange loss

- If you are temporarily working/living in another country and still have bills/debts etc in your home country, use ofx.com to transfer the money over. You can set up a direct payment authorization for your specific bank accounts. You can set up recurring transfers to ensure you’re on time, every time.

- You can lock in a good rate. The AUD/USD rate is good at the moment. Perhaps you’re concerned it may go back down. You can book transfers between two days and twelve months from today, but pay later. It protects you against exchange rate movements.

- If you have an online business and sell on places like Amazon and Ebay. The margins charged by these marketplaces on cross-border payments are nearly 4%. For example, if you sell $200,000 worth of merchandise (yay you!) you can save up to $5,000 just by using ofx.com. Click to read more about that here. I previously used Payoneer to have local receiving accounts, but I’d much rather use OFX.com so I am going to switch over to them.

- If you have an online business and are paid by companies in other countries, you can have it paid via a ofx.com transfer. I am currently testing this as an alternative to using Payoneer. If it works out better in regards to fees, I’ll be dropping Payoneer like a hot rock (see below in regards to their customer service #dreadful)

Customer service with OFX.com

The customer service is outstanding with OFX.com

It must have only been within 30-minutes of me signing up to OFx.com that I had someone phone me to see if everything went okay with my sign up.

As soon as I made my first deal, I had someone phone me again to verify the deal and remind me of the next steps with transferring.

The next time I went to make a deal I had to cancel it because of my confusion on the US banking system. I phoned up, got on the line to someone immediately and they canceled the transaction no problem.

The transaction isn’t final until you’ve transferred the money from your bank account to theirs. It’s not an immediate payment, but you lock in the rate when you put in your order. So if something goes wrong in between the time you can cancel it.

It is very clear during the order process that once you make an order it’s final as they obviously don’t want people just changing their mind and canceling orders.

But in my case, I had to cancel it because I couldn’t transfer the money out of my US bank account to theirs and I was not aware that this would be a problem. Now that is one thing that is simple to do with Australian bank accounts.

The OFX customer service rep asked why I wanted to cancel the order I explained.

He said, “I can help you with that. I”m going to send you an email now with the documents you need. (it was in my inbox before we got off the phone). If you fill out those forms and link your bank account we can automatically take the money from your account for each future transaction.”

“Will this charge me fees?”

“No Ma’am this is how you avoid fees and why we set it up this way.”

You’re freaking brilliant. Helping me avoid paying bank fees. I love you!

Because if I was going to transfer money from my US bank account to another US bank account, my bank was going to charge me fees. Can you believe that?

At least in Australia, they don’t do that. I might have to do more research to clarify that one, but that’s pretty much what was coming up for me.

All of that was settled with one phone call. I can now easily pay any Australian contractor we may still have working in our business effortlessly with a great currency conversion rate and no fees.

I just want to check on their end what fees they get hit with and whether PayPal might come out with a better result for them.

Would this kind of customer service happen with the bank?

You know fees will come with it, probably just for calling – that’s if you can find a phone number on the website to call. Tell me sometimes it takes you half an hour too!

With PayPal?

Their customer service has gotten a little better now. I do tend to hear back within 24 hours but you have to wait until then before you can put in a call.

With Payoneer?

They are the worst so far in my experience of customer service. I’ve gone days, if not weeks, of follow up to hear anything back. And the waiting around has cost me money. Just this week nearly 50 euros.

So you can see I love OFX.com – excellent customer service, no international transaction fees, no international wire transfer fees, and the best foreign exchange rate putting more dollars into YOUR pockets not CEO bonus payouts!

Standing O for OFX. My favorite travel find of the year.

Pin to share this amazing find to Pinterest:

How happy are you to find a fantastic solution for transferring money overseas that will save you money?